Business Insurance in and around Republic

One of Republic’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to consider. We understand. State Farm agent Sarah Rader is a business owner, too. Let Sarah Rader help you make sure that your business is properly insured. You won't regret it!

One of Republic’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

Whether you are an optometrist a sporting goods store owner, or you own an art gallery, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Sarah Rader can help you discover coverage that's right for you and your business. Your business policy can cover things such as money and accounts receivable.

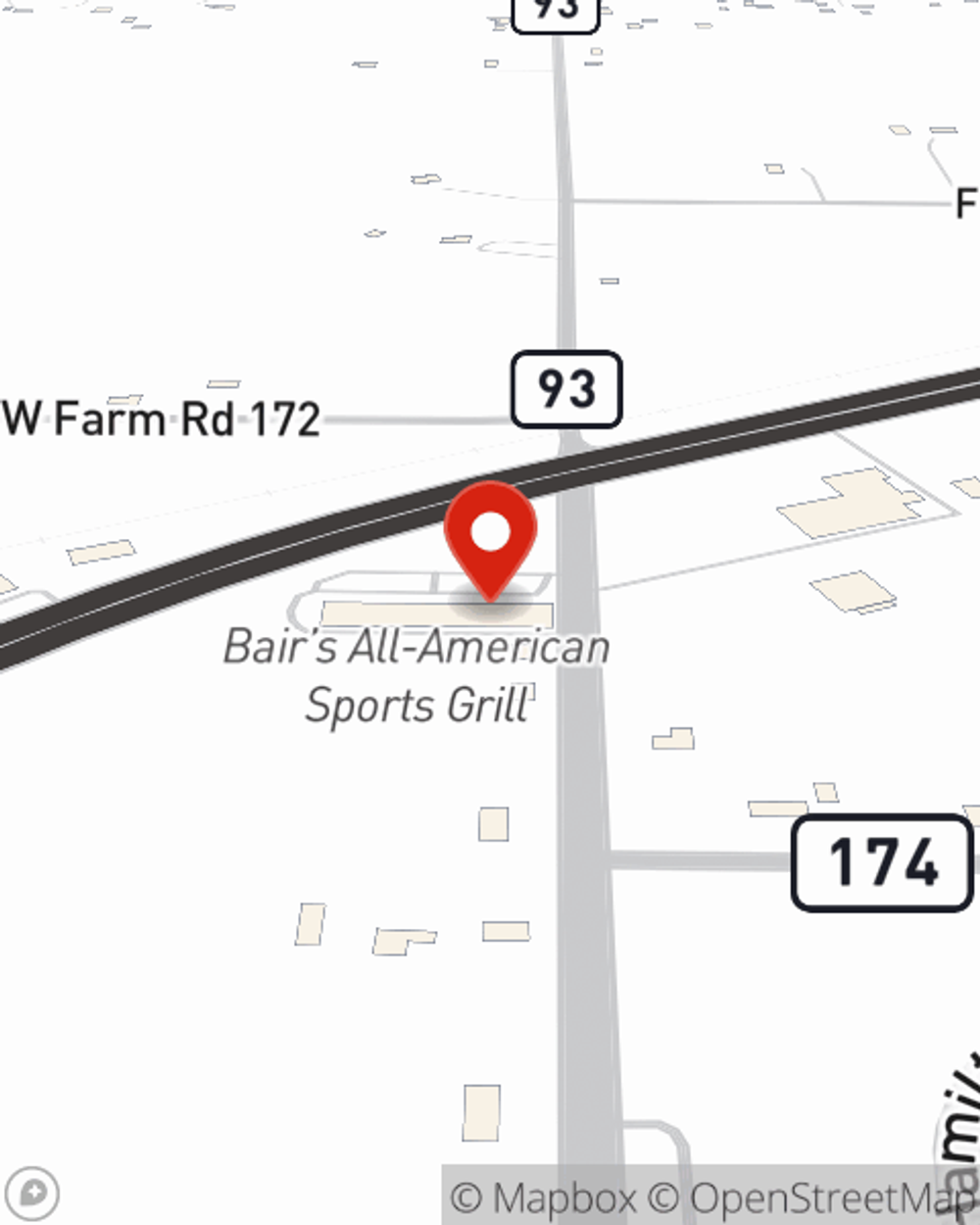

Call or email State Farm agent Sarah Rader today to explore how a State Farm small business policy can ease your worries about the future here in Republic, MO.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Sarah Rader

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.